You are interested in exploring great sports betting strategies that professional, veteran sports bettors use to boost their winning odds? If so, in this detailed guide on the popular Kelly Criterion gambling method, we take a look at how this betting strategy works not only in the world of online casino gaming but also in other fields where money management and asset allocation play an important role.

The main goal of this article is to familiarize you with the basic concept of the Kelly Criterion system that nowadays is widely used in many different gambling forms including sports betting. Regardless of your preferences and bankroll, you need some kind of sports betting strategy to guide you once you go out there and enjoy such activities. In addition to using the Kelly Criterion system, there are many other sports betting strategies, tips, and tricks that can help you boost your winning odds and build your bankroll.

Fortunately, online sports betting fans and enthusiasts residing in the United States have excellent sports betting options and opportunities at their disposal today. One of the most profitable US online sports betting markets is the Colorado sports betting industry, for which operators can be found on BettingBilly.com, closely followed by other states including Delaware, New Mexico, Michigan, Indiana, Illinois, Pennsylvania, Iowa, and West Virginia.

Regardless of where you are coming from, using the Kelly Criterion system can boost your sports betting winning odds, so let’s examine how this system works.

What is the Kelly Criterion?

In its essence, the Kelly Criterion is also known as the Kelly bet or the Kelly strategy is a mathematical formula for sizing bets that when implemented correctly leads to greater profits in the long-term especially when compared to other popular sports betting and gambling strategies. In addition to being widely used by sports bettors, the Kelly Criterion is also used by investors who turn to this scientifically-proven method to calculate what exact percentage of their bankroll or money they should invest per each bet or investment.

The Kelly Criterion system was developed by John Larry Kelly Jr. John Kelly was born on the 26th of December in 1923 in Texas. As a young scientist, he worked at an industrial scientific and research company owned by Nokia, Bell Labs. Over the years, he worked on different projects but he remains best known for his Kelly Criterion system. The Kelly Criterion was developed in 1956 and it heavily relies on statistical probabilities.

As previously mentioned, the Kelly Criterion is used in the sports betting industry to estimate what percentage of profit or bankroll to invest to maximize the return rate. Since it relies on statistical probabilities, the Kelly Criterion is a scientifically-proven betting strategy. When employed correctly, the Kelly Criterion helps you limit your losses and of course, maximize your long-term gains. In this sense, the Kelly Criterion is excellent money management and money allocation system.

The Kelly Criterion and Sports Betting

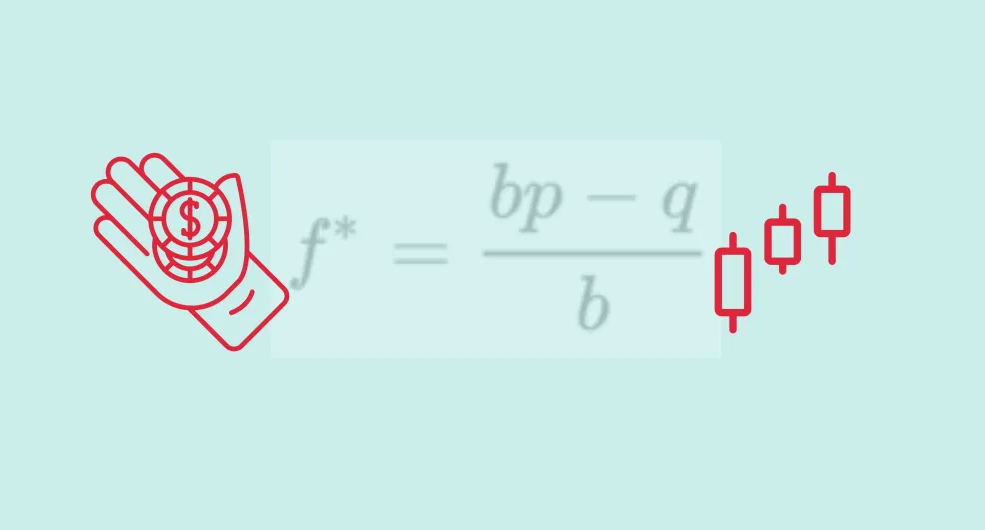

All veteran and professional bettors know all about the importance of money management and diversifying for increasing profits in the long run and this is where the Kelly Criterion system comes. When compared to other money management techniques, this one gives the best results and there are two major components to this money management and asset allocation strategy. The most basic Kelly Criterion equation represents the size of a wager you should invest based on your bankroll. The equation looks like:

K% = The Kelly percentage

W = Winning probability

R = Loss/win ratio

The very first component of the equation is the winning probability or in terms of sports betting, the probability that a given bet will grant a profit. The second part of the equation as mentioned above is the loss/win ratio and the ratio is calculated by dividing the total positive amounts with the total negative amounts. The winning probability and the loss/win ratio when put in the equation give you the Kelly percentage.

With many different real-world uses and applications, the Kelly Criterion is widely used by sports bettors.

Essentially, using this system for sports betting, you manage your bankroll and this is especially important today as sports bettors have almost limitless betting opportunities. Needless to say, having a great bankroll management strategy is one of the major keys to boosting your winning odds and your bankroll in the long-run.

In the simplest words, bankroll management means dedicating a certain amount of your bankroll to betting while you keep track of your wagering history. One of the best options is to turn to the unit approach. In this sense, you think of your bankroll as a collection of units rather than its dollar amount. If you have $100 to spend, with the unit approach you divide this bankroll into let’s say ten units worth $10 each.

How is the Kelly Criterion System Used in Sports Betting?

Following the unit approach explained in the previous section, the value of every unit grows following the growth of your bankroll. On the other hand, if your bankroll is shrinking, the value of every unit goes down. The unit approach system works the best when combined with the Kelly Criterion formula as you need to determine the number of units to bet. The Kelly Criterion system used in sports betting has three main components:

B = Decimal odds

P = Winning probability

Q = Non-winning probability

To understand this better, let’s take the simplest coin toss bet. You can place a bet on a coin toss with +100 odds or 2.00 decimal odds and the probability of the coin toss showing heads is fifty-five percent. In this sense, the probability of winning is 0.55 while the probability of non-winning is 0.45. Lastly, the decimal odds for the equation are valued at 1 for this example.

In order to use the Kelly Criterion formula in the real world on sports betting, first, you need to identify bet values in addition to boosting your bankroll management. When you know how to uncover the best sports betting options out there, incorporating the Kelly Criterion strategy can definitely help you boost your profits, even more so if you bet at Bitcoin sportsbooks with minimal house edge. To get started, the best option is to turn to Kelly Criterion online calculators and once you genuinely understand how this works, you can use the formula by yourself.