Are you planning to get a loan? If the answer to this question is yes, you need to check the legitimacy of the company. Many people often forget to research everything before applying for a loan. They end up losing their money due to the scammers. Therefore, it is crucial to consider some things when selecting a loan company. You don’t have to worry. In this article, we will discuss them in detail.

The demand for loans is increasing with each passing day. It is because many businesses, as well as people, are facing financial problems. Loans can be beneficial in many ways. Suppose you want money to buy a home. You can apply for the same in a reliable bank.

With the rise in technology, it has become much easier to get a loan. All you need is a device and the internet. Various online platforms offer loan services to people. You have many options regarding the same. If you are looking for a reliable one, you can visit

Are you planning to get a loan? If the answer to this question is yes, you need to check the legitimacy of the company. Many people often forget to research everything before applying for a loan. They end up losing their money due to the scammers. Therefore, it is crucial to consider some things when selecting a loan company. You don’t have to worry. In this article, we will discuss them in detail.

The demand for loans is increasing with each passing day. It is because many businesses, as well as people, are facing financial problems. Loans can be beneficial in many ways. Suppose you want money to buy a home. You can apply for the same in a reliable bank.

With the rise in technology, it has become much easier to get a loan. All you need is a device and the internet. Various online platforms offer loan services to people. You have many options regarding the same. If you are looking for a reliable one, you can visit allthebestloans.com. They provide excellent services to the customers.

You might be curious to know some things to identify if a loan company is legitimate or not. So, let’s get started with it without wasting any more time.

What are the things to consider while selecting a loan company?

Researching is necessary when it comes to choosing a lender. You must remember the following points during the process:

1. Check the website

The first thing you need to check is the website. Whenever someone reaches you for a loan, you should ask for the website. After getting the name, check if the site is secure or not. There are two things you need to keep in mind while doing the same:

- Look at the HTTPS protocol. If there is ‘s’ present in it, it means it is a safe website.

- You will see a padlock symbol on every secured site.

Some scammers do not even have an online site. If that is the case, you should not trust them and give them your confidential information. Otherwise, you might lose your hard-earned money.

2. Beware of pressure tactics

Some businesses pressure the customers to get credit. You need to be very careful while deciding because using pressure tactics on customers is a warning sign. However, you should not think that every company is fraudulent. It is better to get all the necessary details about it.

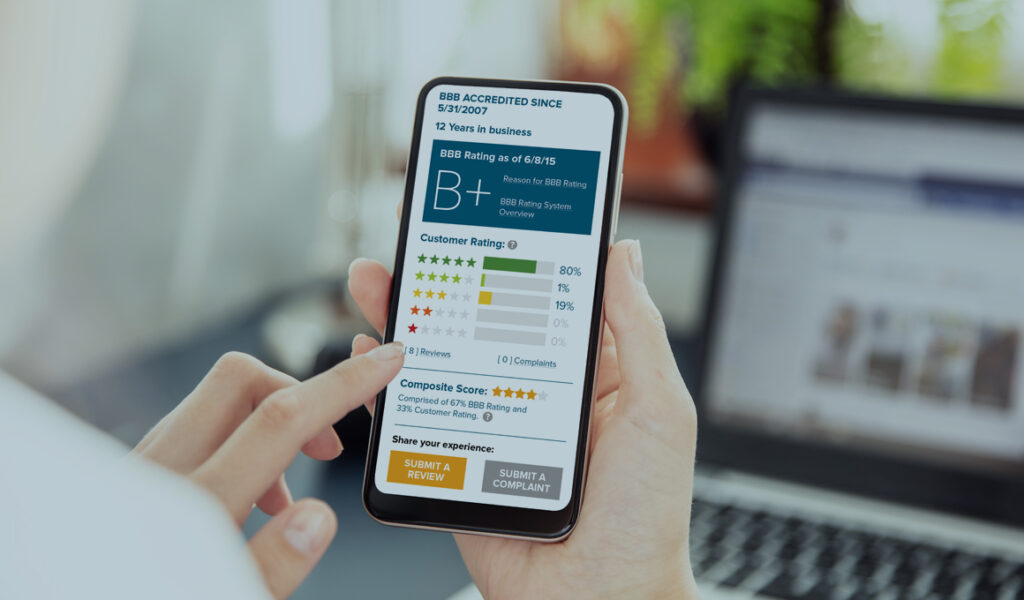

3. Check online reviews on BBB:

Another crucial thing to do is find out the grade of the business on Better Business Bureau. Every provider is graded according to the quality of services they provide to the users.

The best thing about using it is that you can also get to know some companies in detail. In this way, you will be able to recognize if the lender is legitimate or not.

Also, you can make your research more accessible by choosing one that has a good grade. You don’t have to go anywhere for the same.

4. Advanced payments should not be included

You might have heard about advanced costs. If a lender is asking for upfront money, it is a scam. You should not continue your interaction with him because they can harm you in various ways.

All the legalized businesses do not demand advanced money to approve and process your loan.

5. Comfort level matters a lot

Many people often get irritated by the regular phone calls of the lender. Sometimes, they don’t even research appropriately about the plans offered by the company. After getting irritated, they agree with the same. You should never decide on the credit as it might not be suitable for your future.

So, our tip is to stop interacting with the lender the moment you feel uncomfortable. You should not finalize anything without getting all the facts. Some business employees are unfriendly, aggressive, and rude to customers. If you ever come across a person like this, make sure to block the contact. It is a piece of solid evidence that he is a scammer.

6. Fees are not transparent

Scams happen because of a lack of awareness among people. The only way we can stop it is by taking steps carefully. When it comes to lending, the scammers will not disclose the interest rate. On the other hand, every legitimate loan company will provide you with a detailed guide about it.

It is because their main objective is to improve your satisfaction. You will also have the option to read the company’s terms and conditions. After analyzing these things, it is time for you to select the best one.

7. Analyze the plans offered by the lender

If you have found a reliable loan business, they will tell you the best plans according to your income. It is not the case with fraudulent ones. They only need your money with the help of scamming.

8. Get company’s address information

Only email ID and website are not sufficient to determine the legitimacy. A physical address is also necessary to find how trustworthy the lender is.

It is a pretty challenging task to catch the scammer once they have done his job. They will not provide you with any contact details like phone number, address, ID, and more. So, a victim will not be able to catch him to get the money back. It is an impossible thing for everyone.

9. Unsolicited loan approval

You might be surprised to know that some fraudsters even approve the loan under your name. It usually happens when you share your details without proper research. If you ever get into such a situation, you should generate a complaint immediately.

10. Check if the company is registered

Last but not least, you should check whether the company is registered or not. The government gives special licenses to the loan providers.

The Bottom Line

From the above information, we have concluded that finding a legit loan company is hard. However, one can easily do it by taking some simple steps. We hope this article helped you in understanding about the same in detail.